A financial health companion that turns mobile apps into a powerful growth engine for deposits, loyalty and revenue

Smart tools and tailored insights designed for sales teams

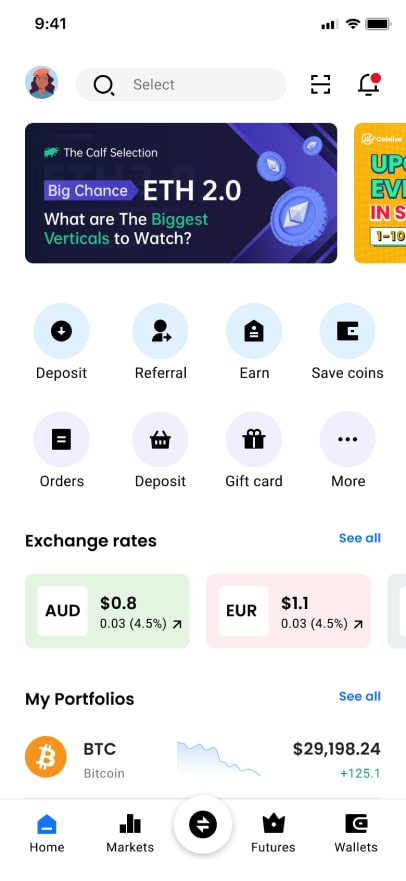

Personalized for you

Personalized financial content. Including posts, nudges, and bank-approved messaging, tailored to user behavior, goals, and peer interactions.

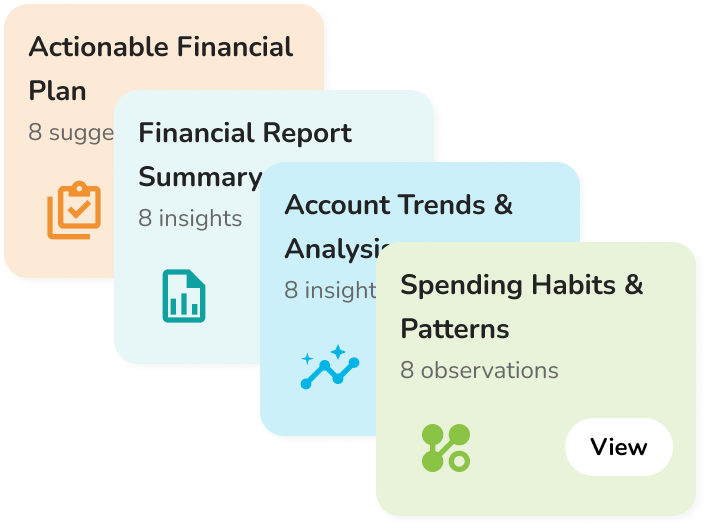

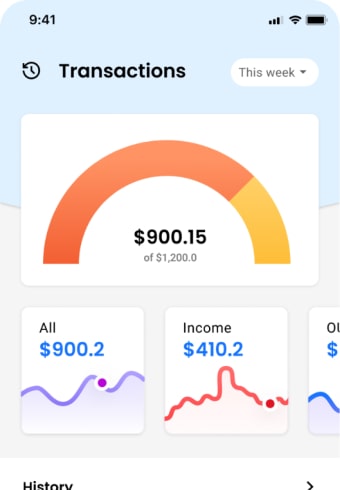

Smart Financial Reports

Provide AI-driven financial health reports across all linked accounts with actionable insights

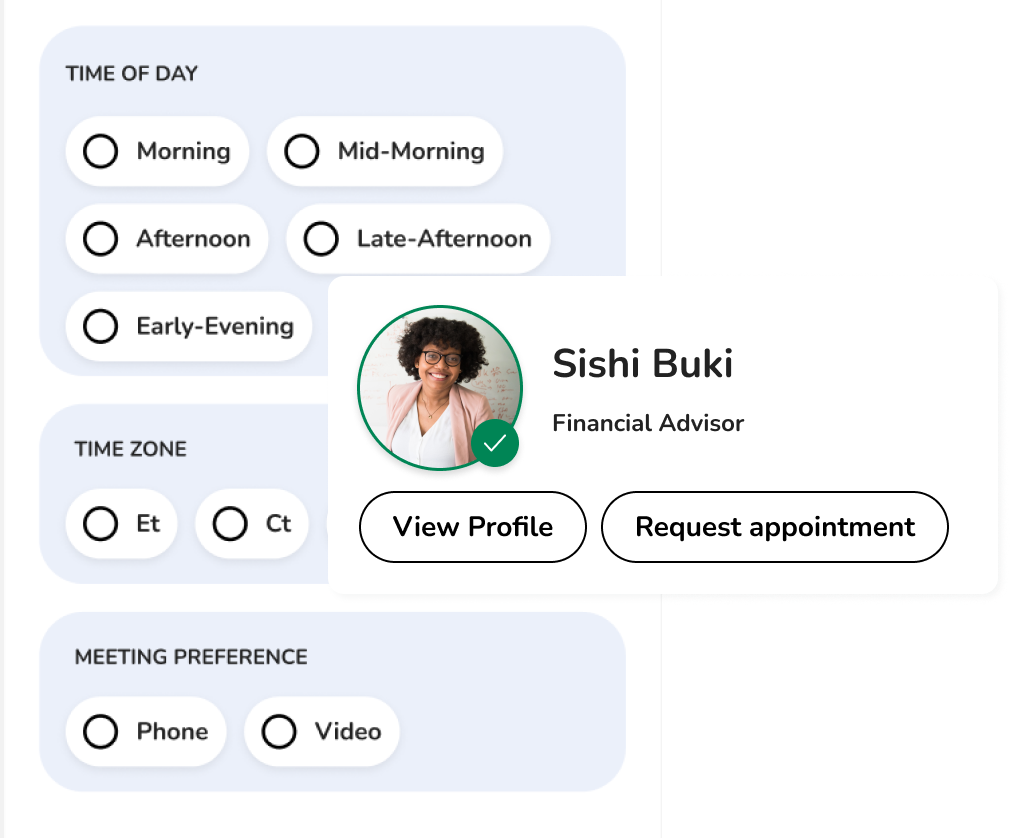

Expert Connections

Connect with top influencers and financial experts to gain insights and grow smarter.

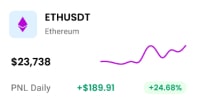

Track your Finances

Track your finances effortlessly—monitor spending, manage budgets, and stay in control of your money.

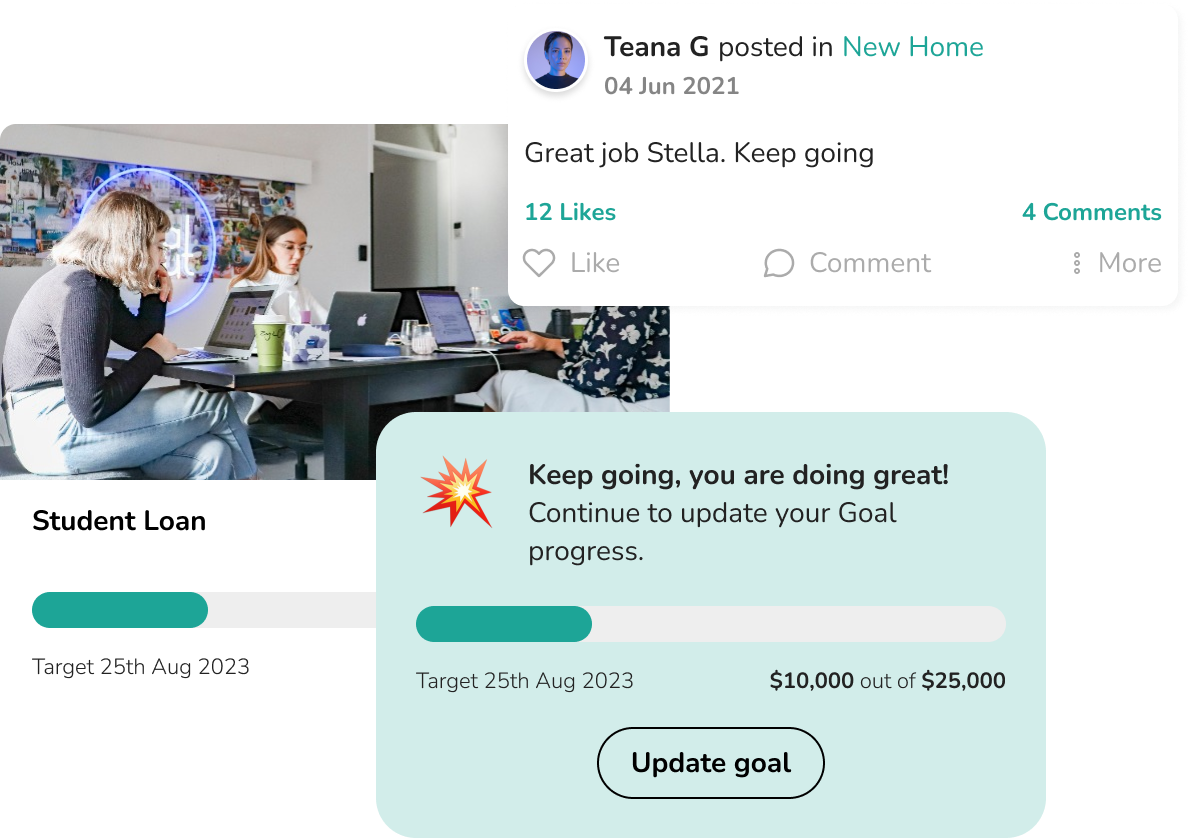

Accelerate your savings

Stay on track by creating, updating, and monitoring your savings goals.

Revenue Generating Opportunities

Configurable opportunities designed to adapt to your unique business model.

Unlock Revenue with Wellthi

Virtual Financial Advisor

To provide a hyperpersonalized customer experience to every customer

Emotional loyalty

Customer communities showcase approved bank content & resources (e.g., calculators) tailored to key life events (e.g., starting a family, divorce) to improve acquisition & retention.

Individualized Financial Health Plans

Intelligent nudges encourage customers to act on tailored advice on products/services, AI-powered financial health insights

Successful transfer

$69.95

Turn data into AUM

Low Cost Deposits

Goal-based journeys motivate users to achieve their financial objectives through gamification and positive peer influence.

Drive Card Volume & Spend

Customer communities showcase approved bank content & resources (e.g., calculators) tailored to key life events (e.g., starting a family, divorce) to improve acquisition & retention.

In-App Subscription Fees

Generate non-interest income with Wellthi perks and special offers for consumers and small businesses

Transforms small teams into a force multiplier

Content Curation

Turn static, underperforming content into snackable social networking content while ensuring compliance and data privacy

Customer Relationship Management

Makes it easy to create, post, optimize and learn how to cross-sell the right problem at the right time

Unique Data Insights

Offer best-in-class martech that provides real-time data insights from customers and industry trends

Launch in weeks

No core integration required

Launch in weeks — No core integration required

- No integration required with bank core processors or cardholder interfaces

- Technical implementation: 4 weeks

- Light integration

- Implementation: 8 weeks

- Full integration on-premise

- Implementation: 24 weeks

Maggie Wall

Head of Diverse Growth Segments

Innovation-driven projects like this one with Wellthi are critical to our communities. Access to advice is really important, and making sure that everyone has the ability to be able to jump in and learn more. I am so proud of the partnership with Wellthi, an app that will help individuals take charge of their financial future!

Reneé Sattiewhite

President & CEO

The first time I saw the Wellthi App demo, I knew this was an absolute game-changer for the credit union movement.

Wole Coaxum

MoCaFi CEO & Founder

Our partnership with Wellthi Technologies aligns perfectly with MoCaFi’s mission to help excluded communities create wealth through better access to public, private, and social capital. The ‘On Our Block’ initiative will bring our banking products and financial programming directly to the neighborhoods that need them most, supporting Black and brown communities in building personalized pathways.

Blanche Jackson

SSCFCU CEO

Everything we do is to better the community. That is why the partnership with Wellthi and Discover Card are so important as this will better the community we serve in Delaware greatly.

Bishop T.D Jakes

Chairman at T.D. JAKES

By partnering with Wellthi Technologies, we are committed to equipping individuals with the resources and knowledge they need to build a better financial future for themselves, their families, their businesses, and the community at large.

Request Full Report

Reach Out!

Wellthi & Citizens Pilot

Citizens and Wellthi partnered to test the effectiveness of social finance in deepening customer relationships for financial advisors and retail bankers.

Users who created an account after downloading the app.

Users who liked, commented, shared, or scheduled an appointment per month

Users who logged-in every 30 days after downloading the app1

Users who requested and attended a financial advisor appointment

Read everything about corporate finance

Sponsored by This week I’m diving into one of the most under-the-radar trends shaping the future of money: social trading. And no, I don’t mean ESG funds. I mean investing that’s literally social—group chats, FinTok, copy trades, meme stocks, and money moves powered by peer pressure and digital high-fives. This topic is so important that […]

In partnership with As a fintech founder who partners with community banks and credit unions, I’ve seen the $100 trillion wealth transfer looming on the horizon – and it’s both an enormous opportunity and a wake-up call. Over the next two decades, an estimated $80–$84 trillion will pass from aging Baby Boomers to their Gen […]

It’s 11 p.m. on a Tuesday and your MilZ customer has a question about how she should use her inheritance. Is she willing to wait until morning to call your 1 800 number? Absolutely not. The data shows that she will most likely hop on #FinTok and see what her favorite creator might recommend. Millennials […]

This issue, I want to delve into how savvy financial institutions are innovating to win America’s HENRYs and HIPOs early. Millennial and Gen Z HENRYs (High Earners, Not Rich Yet) are rising professionals who might be future millionaires, but today they’re more pre-wealth than wealthy. Think of high potential (HIPO) individuals like a 28-year-old software […]

Wealth and wellness. Our generation demands both. If you still think financial wellness is just a fluffy HR perk or a nice-to-have product feature, you’re missing the moment. Gen Z and Millennials—aka MilZ—have flipped the script on how they think about money. For them, money isn’t just about wealth anymore. It’s about wealth + well-being; […]

As a millennial fintech founder, I’ve seen firsthand that Gen Z and Millennials are rewriting the rules of banking. Our generation represents about 30% of the global population. Nearly 50% of us manage our finances entirely via phone. We don’t just prefer digital-first experiences – we demand them. We expect our banking app to be […]