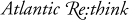

AI Financial Health Companion

Wellthi’s social finance technology supercharges your mobile app into a powerful growth engine for low-cost deposits, customer loyalty, and revenue.

With Wellthi, wealth management, data and analytics, and retail banking teams can leverage AI-powered savings journeys, financial insights, and social feeds to deliver the right product at the right time — not just to individual customers, but also to their peers — while capturing a treasure trove of unique data insights for your team.

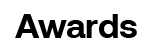

Turn Your Team Into a Force Multiplier

With Wellthi groups, your loan officers and financial advisors can service large groups of people with similar financial goals – at scale. Wellthi goals offer a streamlined member experience designed to help members open a membership, and funds account in minutes using their existing online account opening and origination capabilities.

Best-in-Class Content Management

We partner with industry leaders like Salesforce to make it easier for your staff to manage online communities, member inquiries, and Wellthi referrals from their desktop computers to your virtual branch in-app. Wellthi’s client management system (CMS) is safe, secure, and FINRA friendly. It includes various content creation, management, and monitoring tools that can be configured for any use case, from retail to small business to wealth management.

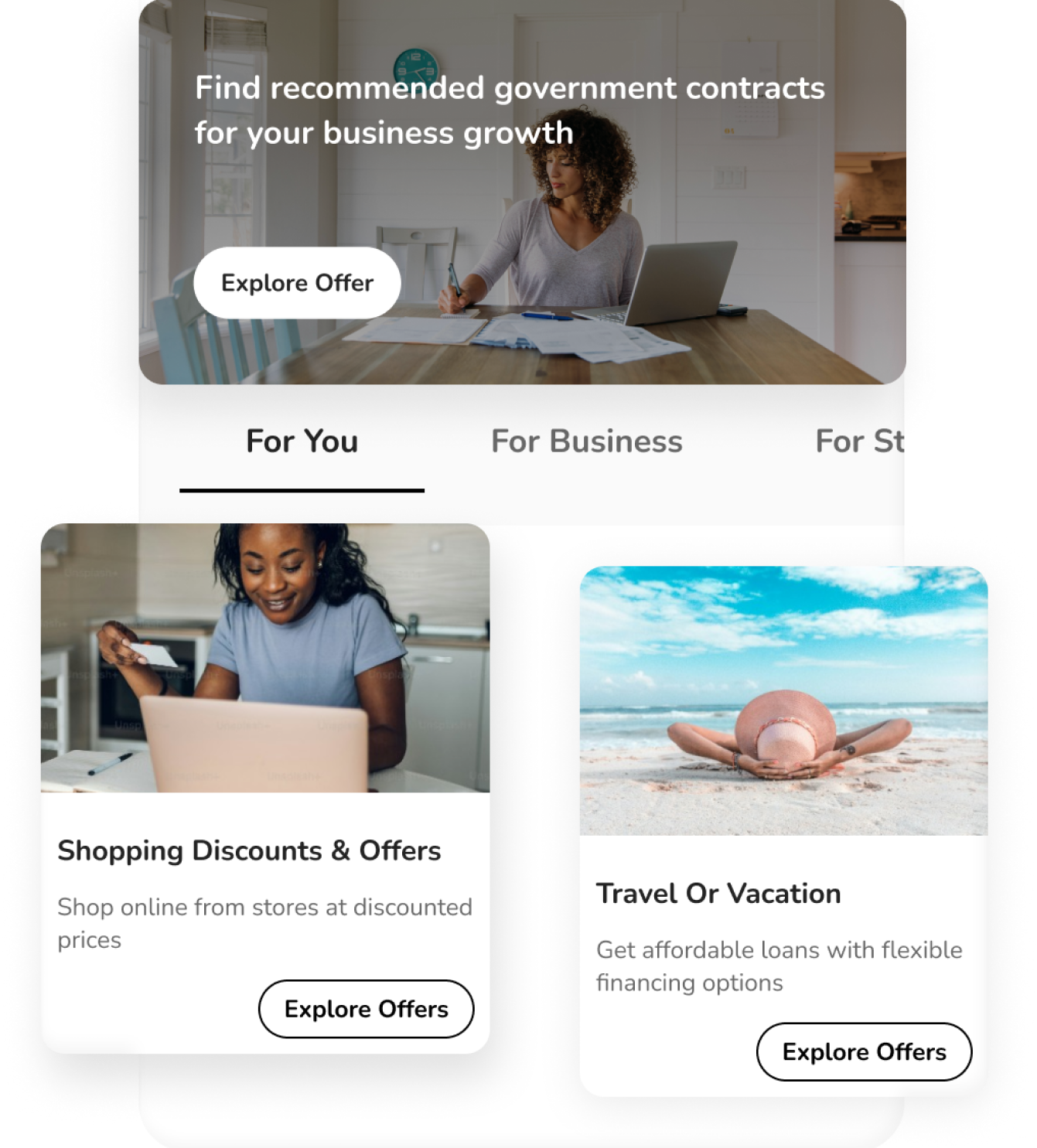

Configurable Revenue Generating Opportunities

With Wellthi’s Marketplace & Member Engagement Tools,

Wellthi can help you generate alternative revenue streams with our virtual member marketplace. Wellthi’s highly configurable marketplace offers exclusive Amazon discounts, financial health products and services to help your institution gain greater share of wallet.

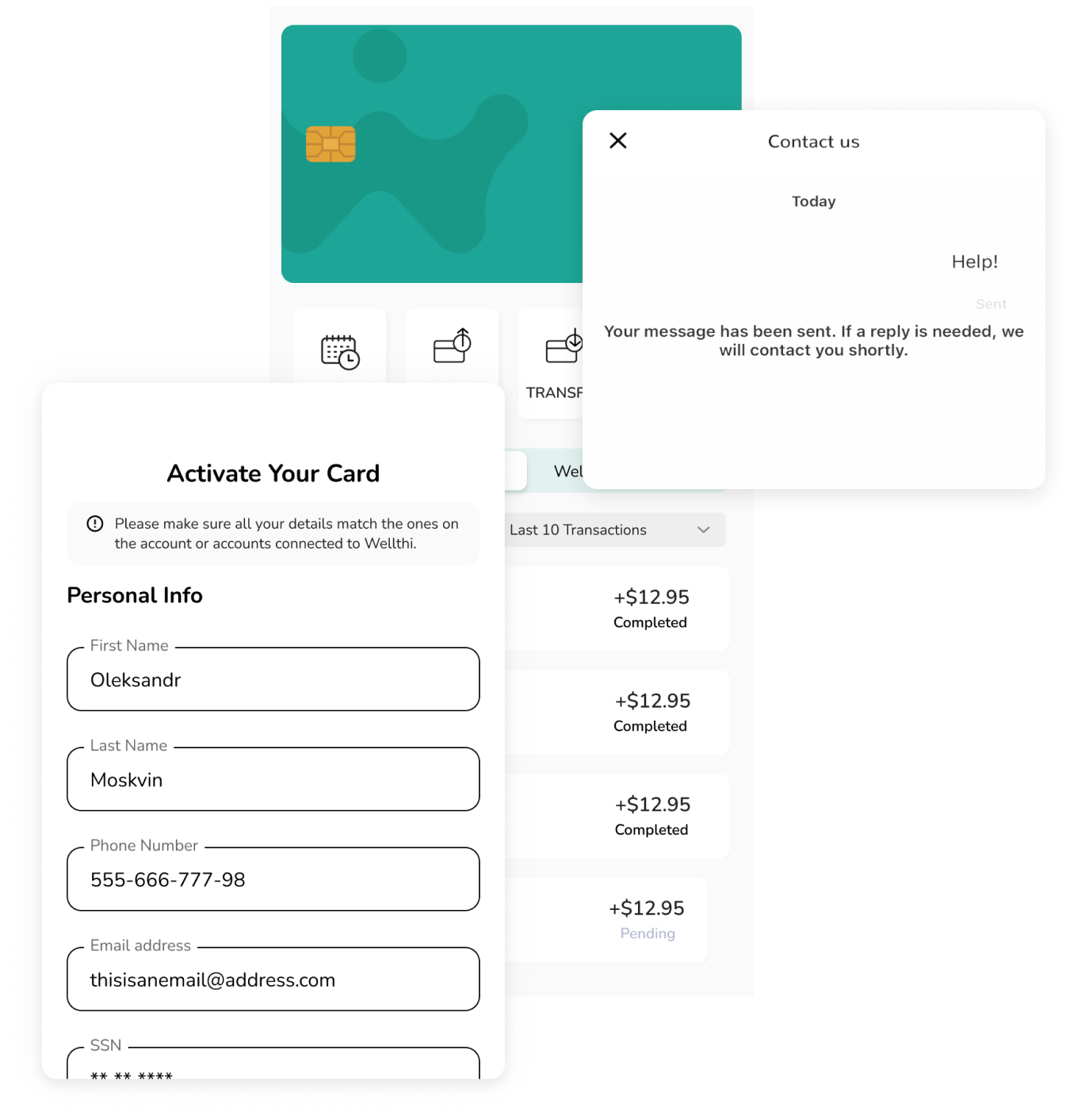

Bank-Grade Compliance & Cybersecurity

Wellthi is SOC 2, Type 2 certified and American Disablities Act (ADA) Compliant and U.S. Data Privacy Compliant. Our virtual branch offers a seamless way for your team to automate identity verification and account oversight to prevent fraud securely and cost-effectively without sacrificing the member experience.

Digital Wallet & Cards

Wellthi has partnered with Mastercard, Visa, and Disover to offer a suite of B2B cobranded payment solutions that complement—not compete with—your core debit and credit card offerings.

Credit Builder Cards

Helping members transition from secured to unsecured credit lines

Wellthi’s cobranded credit card offers a credit-building solution that cultivates the financial health of nonprime members and denied loan applicants. Coupled with the virtual branch, Wellthi makes it easier for your team to help members who need support build strong credit by reporting transactions, eligible subscriptions, and utility bills to TransUnion, Equifax, and Experian and improving financial acumen with peers. We track credit readiness and notify your team when members are most likely to be approved for a loan or credit card.

Prepaid Card & Digital Wallet

A great tool for dispersing loans or affinity cards

The Wellthi cobranded prepaid card and digital wallet offer a great way to distribute loans to small businesses and consumers.

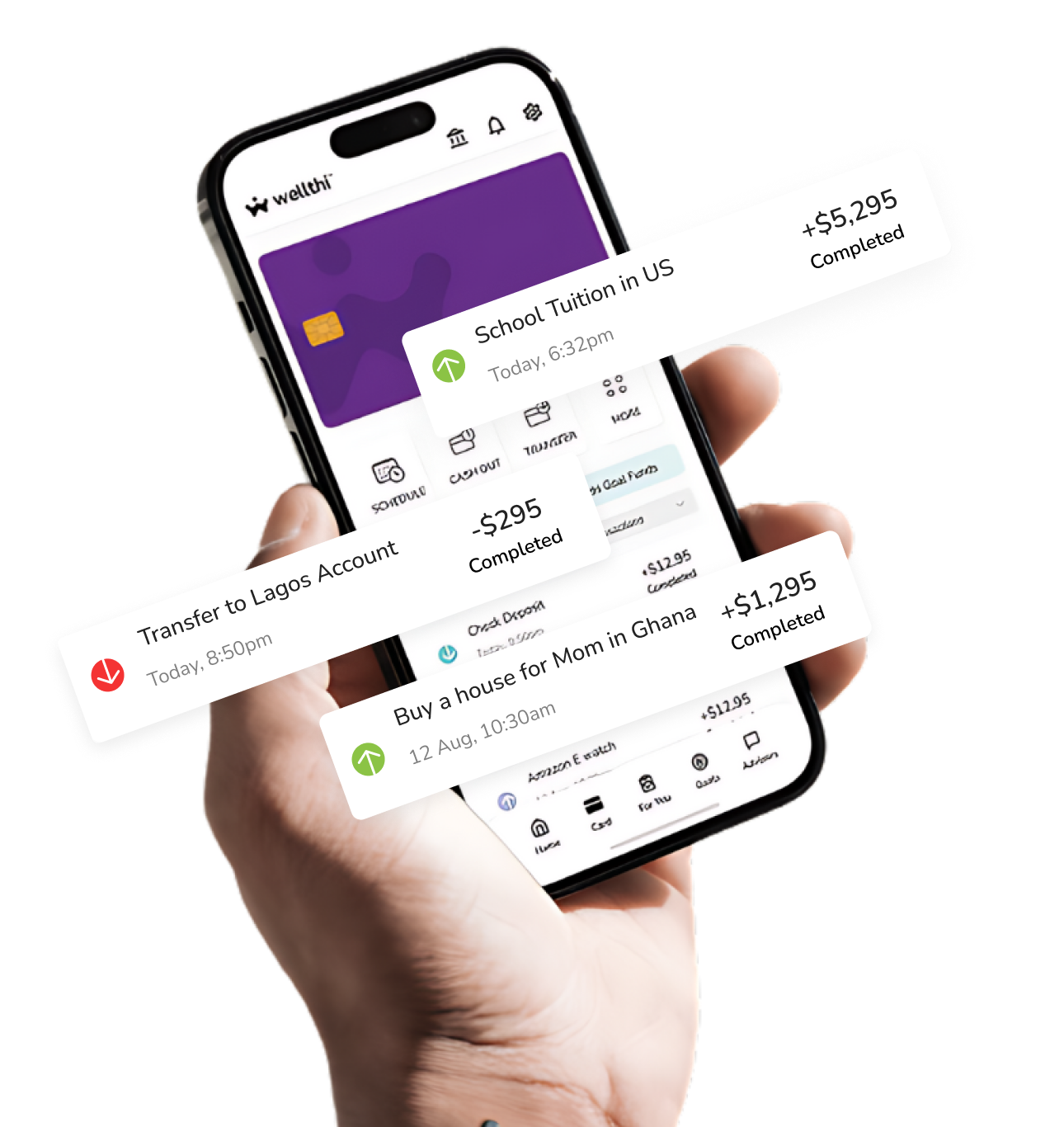

Remittance Wallet & Card for Diaspora Banking

Capture Remittances & Service Diaspora Customers Anywhere

We facilitate cross-border payments and capture a greater share of remittances from multicultural members. We offer a suite of digital account issuance services that facilitate international payments, including:

- Automated KYC and OFAC screening.

- KYC & Confirmation of Residential Address in the US.

- Cross-border payments that allow member to remit money account-to-account, card-to-card or P2P.

We offer a variety of options so you can white-label and configure Wellthi for your mobile banking app.

Enterprise

Mobile Integration

Bank Agnostic Software

Development Kit (SDK)

Full integration