Apply for a grant to seed or grow your small business banking portfolio

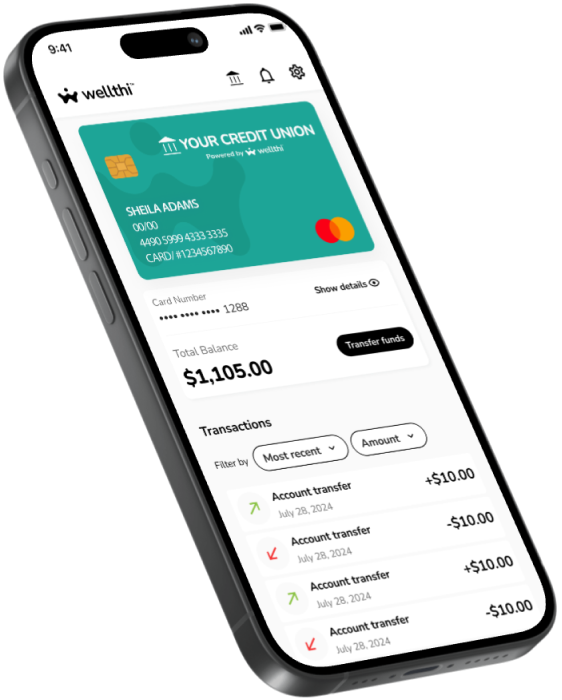

Wellthi Small Business Banking with

MilZ Grant Program

Over 80% of Americans under the age of 50 are getting their financial advice from untrained, unaccredited influencers – not banks. Wellthi’s virtual branch offers a solution that bridges banks to the younger generation.

The Banking MilZ Grant Program helps financial institutions leverage the power of social networking and AI to deepen customer relationships with millennial and Gen Z consumers and small businesses at a fraction of the cost..

Grants funds will be used to white-label, configure and launch a Wellthi small business virtual branch and small business credit card.

Participating financial institutions can use this opportunity to:

- Earn non-interest income without the burden of issuing a new card program

- Attract and retain small business customers

- Earn incremental EBIT of up to $40 per cardholder per year with Wellthi’s’ revenue sharing program

Funding Opportunity

This grant program will help offset the cost with up to $48,000 in grant funds and services valued at over $1 million.

Eligibility for the Grant

- Must be an Accredited depository institution

- Must schedule a consultation with the BankingMilZ program team

Deadline to Apply: June 30, 2025

In Partnership With

How it works

01

Schedule

a consultation

Attend a solutions webinar to learn more about Wellthi's virtual branch and credit builder card for small businesses

02

Apply for the grant by June 30, 2025

We know how busy you are, so we have made the applicaiton process simple and easy.

03

Winners will be notified July 19-23, 2025

The selection committe will announce winning applicants via email and on the website.

Download the Request for Proposals (RFP)

Frequently asked questions

My financial institution already offers small business banking services. Can I still apply?

Sure. This grant program is designed for financial institutions that want to seed or grow their small business banking portfolio. Financial institutions with existing small business services can utilize this opportunity to complement their business banking services with a virtual branch and secured card program designed to help financial institutions attract and retain more small business members and generate non-interest income from Wellthi’s revenue sharing program.

Who Issues the Card Program?

Wellthi’s agent bank issues the card program.

Explain how my financial institution can earn passive income?

Wellthi’s secured card program is incudes a revenue sharing component with each financial institution. Financial institutions can benefit from incremental EBIT of ~$40 per cardholder per year. The tier 3 product offering breaks even at 3,100 cardholders. At 5,000 cardholders, financial institutions can expect $75k EBIT per year. See slide 9 for more details.

What are the responsibilities for participating financial institutions once the grant program ends?

This grant covers the first year of the project. Participating financial institutions are responsible for all virtual branch and card program costs after year two.

How can Grant funds be utilised?

Grant funding can only be utilised to support the setup and maintenance fees for the Wellthi branch and Mastercard program.