Modernize your credit union with small business banking

Generation Boost Small Business Grant Program

for Credit Unions

Is your credit union interested in offering small business banking services to members?

The Generation Boost Small Business Banking Grant Program can help with that. Wellthi and Mastercard are partnering with the African American Credit Union Coalition (AACUC) to offer small business banking grants to members that want to seed or grow their small business banking portfolio.

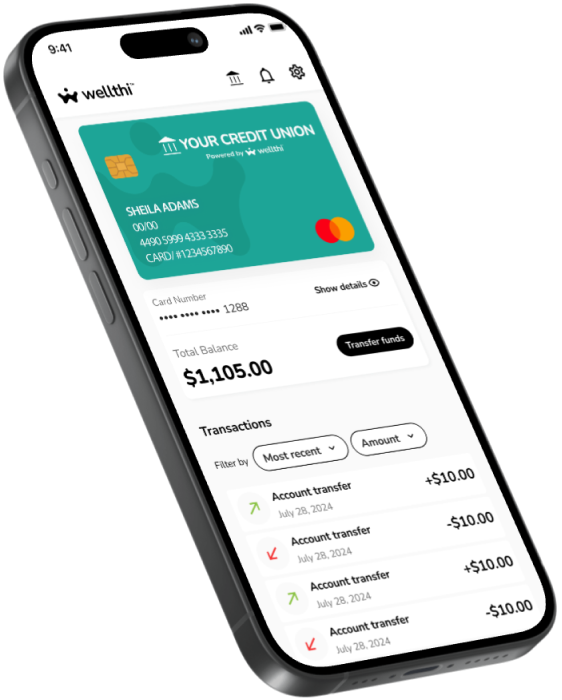

Grants funds will be used to white-label, configure and launch a Wellthi small business virtual branch and small business credit card.

Participating Credit Unions benefit from a 50% revenue share of all card and transaction fees.

- Earn non-interest income without the burden of issuing a new card program

- Attract and retain small business customers

- Earn incremental EBIT of up to $40 per cardholder per year with Wellthi’s’ revenue sharing program

Funding Opportunity

This grant program will help offset the cost with up to $48,000 in grant funds and services valued at over $1 million.

Eligibility for the Grant

Applicants must schedule a consultation with the Generation Boost Grant Team before submitting their application.

Deadline to Apply: April 30, 2025

In Partnership With

How it works

01

Schedule a consultation

Attend a solutions webinar to learn more about Wellthi's virtual branch and credit builder card for small businesses

02

Apply for the grant by April 30, 2025

We know how busy you are, so we have made the applicaiton process simple and easy.

03

Winners will be notified May 19-23, 2025

The selection committe will announce winning applicants via email and on the website.

04

Attend launch event at AACUC Annual Conference in Atlanta July 21-24

Let's celebrate at the annucal conference with the AACUC, Mastercard and Wellthi.

Download the Request for Proposals (RFP)

Frequently asked questions

My credit union already offers small business banking services. Can I still apply?

Sure. This grant program is designed for credit unions that want to seed or grow their small business banking portfolio. Credit unions with existing small business services can utilize this opportunity to complement their business banking services with a virtual branch and secured card program designed to help credit unions attract and retain more small business members and generate non-interest income from Wellthi’s revenue sharing program.

Who Issues the Card Program?

Wellthi’s agent bank issues the card program.

Explain how my credit union can earn passive income?

Wellthi’s secured card program is incudes a revenue sharing component with each credit union. Credit unions can benefit from incremental EBIT of ~$40 per cardholder per year. The tier 3 product offering breaks even at 3,100 cardholders. At 5,000 cardholders, credit unions can expect $75k EBIT per year. See slide 9 for more details.

What are the responsibilities for participating credit unions once the grant program ends?

This grant covers the first year of the project. Participating credit unions are responsible for all virtual branch and card program costs after year two.

How can Grant funds be utilised?

Grant funding can only be utilised to support the setup and maintenance fees for the Wellthi branch and Mastercard program.

My credit union is not an AACUC member. Am I still eligible to apply?

Yes! If your credit union is in the $500 million or less asset category you are highly encouraged to apply. All you have to do is register to be an AACUC member by the deadline. Visit this link https://www.aacuc.org/membership-benefits/ for information on AACUC member benefits and registration requirements.