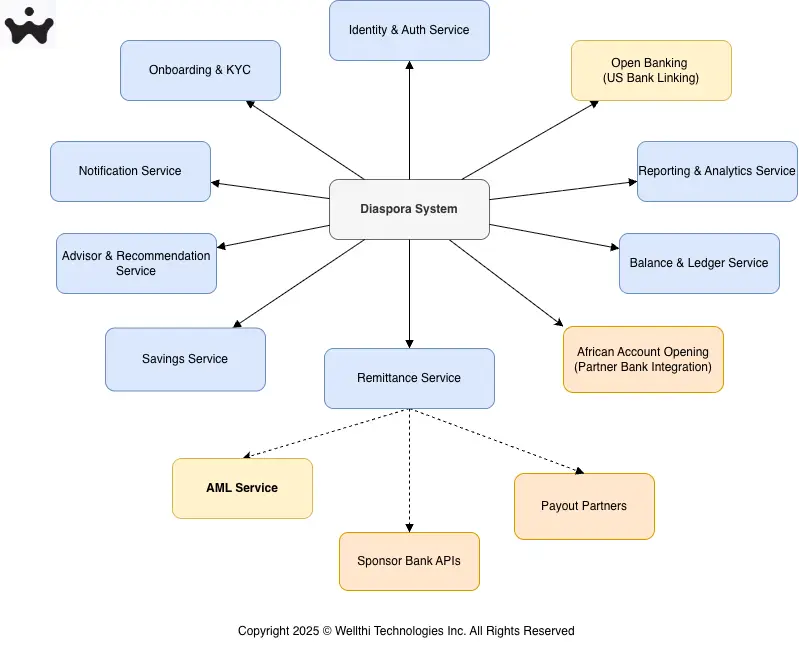

The Diaspora Remittance & Savings Platform is composed of the following high-level services and functional domains:

- Identity & Auth Service

- User registration, login, and password/PIN management.

- Token management (JWT or equivalent).

- Session validation and enforcement of security policies

- Onboarding & KYC Service

- Document upload, address collection, and biometric (face) verification

- Storing and tracking KYC decisions, including failed verifications

- Enforcing required KYC levels for actions such as wallet access and sending money

- Account Linking Service

Provides connectivity to U.S. bank accounts via open-banking providers:- Integrates with the open banking aggregator in the USA & Canada.

- Secure tokenised linking of a user’s U.S. bank account

- Linked accounts are used as funding sources for transfers and account top-ups

- Remittance Service

Central layer for all cross-border payments:- Handle money movement between U.S. Accounts to the African Banks (cross-border).

- Integrates with the sponsor bank in the USA.

- Integrates with payout partners for cross-border payments (bank, mobile money)

- Handles Currency Exchange rate, calculation, and displays rates.

- Applies compliance checks, transaction limits, and routing rules

- African Account Creation (TBD with Financial institution)

Supports opening and managing bank accounts for senders in Africa:- Integration with the Financial institution to present available account options

- Initiates the loan application process, KYC, and identity verification required for account opening

- Enables users to top up these accounts and monitor balances from within the Diaspora app

- Balance & Ledger Service

- Tracks user and system balances across multiple currencies

- Records all ledger entries for deposits, transfers, conversions based on the configuration and fees, savings contributions, etc.

- Maintains transaction logs for audit, reconciliation, and reporting

- Savings Service

- Supports personal goals (create, view, update progress)

- Executes manual and scheduled (automated) contributions

- Handles goal withdrawal, settlement, and cancellations

- Integrates with bank investment products (where applicable)

- Advisor & Recommendation Service

- Lists advisors and profiles.

- Manages appointment booking and notifications.

- Provides personalised product offers (“For you” module).

- Notification Service

- Push notifications for transactions and alerts.

- SMS and email confirmation for the transactions (Fees may apply for SMS).

- Optional integration with WhatsApp for advisor appointments or reminders.

- Reporting & Analytics Service

- Provides transaction analytics for U.S. & Canada accounts.

- Generates downloadable reports for users and internal teams.

- Enables users to view detailed activity logs, history, and statements

- Supports internal dashboards for monitoring performance and trends