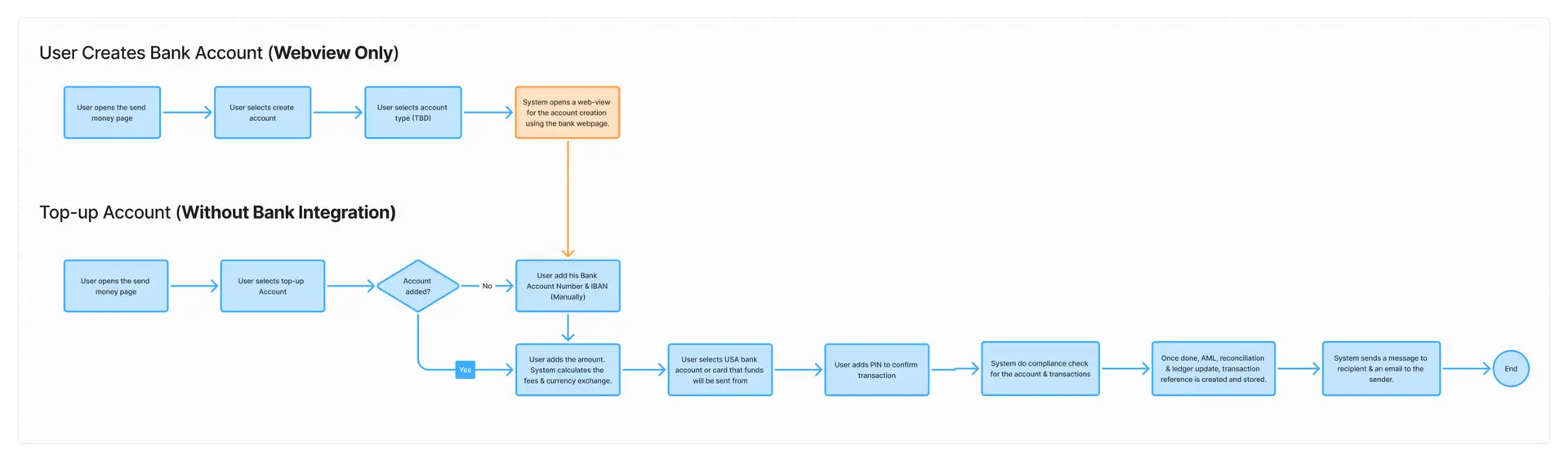

1. Integration-free Account Creation

The simplest integration path requires no real-time API connectivity with the financial institution.

- The user is redirected to a secure bank-hosted webview to create an African bank account.

- All KYC, document collection, and account setup steps happen inside the bank’s web experience.

- Once completed, the user returns to the Diaspora app.

- User needs to manually add their created account details to be able to top up the account using the diaspora app.

- The Diaspora platform does not have account balance visibility, since the bank does not expose APIs in this model.

Pros: Fastest time-to-launch | Minimal integration effort | Bank controls full onboarding experience and compliance workflow

Limitations: No real-time account verification | No balance sync | No instant confirmation |Requires users to add their accounts manually.

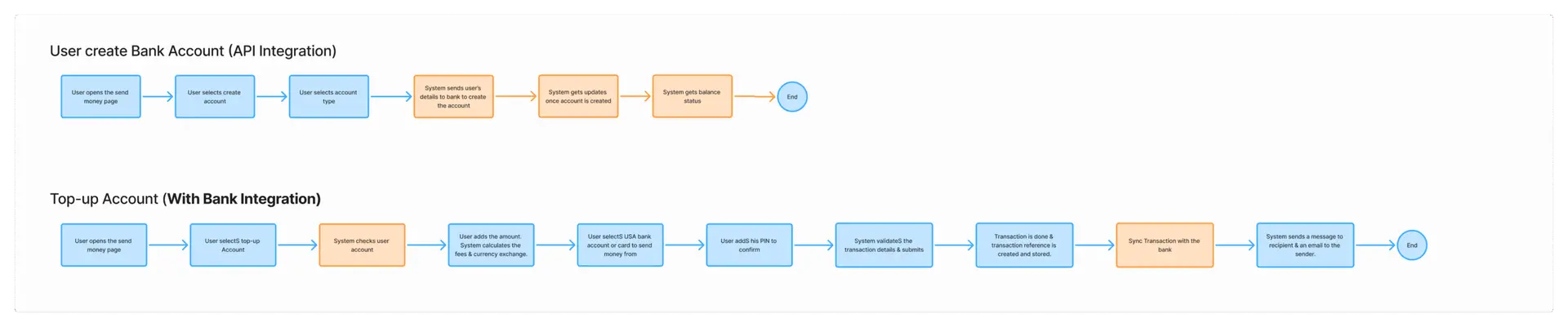

2. API-Integrated Account Creation

This model provides a fully embedded banking experience, offering the most seamless and scalable user journey.

- The user can create a new African bank account directly inside the Diaspora app using APIs exposed by the financial institution.

- The platform sends verified KYC data (from the existing U.S. onboarding flow) to the bank’s system.

- The bank performs validation and returns the newly created account details.

- Account approval is confirmed through APIs.

- The user can immediately top up their new account via integrated payment rails.

- Account balance and status are synced back to the Diaspora app at regular intervals or through webhooks.

Pros: Fully native experience| Real-time account sync |Instant top-up confirmation| Better compliance alignment through shared KYC

Cons: Higher integration effort | Longer implementation time | Requires close coordination on compliance and KYC rules | Higher cost

|

Aspect |

Webview Model |

API-Integrated Model |

|---|---|---|

|

Integration Complexity |

Low |

High |

|

Time to Market |

Fast |

Longer |

|

User Experience |

Redirect-based |

Fully native |

|

Compliance Alignment |

Bank-driven KYC/AML only |

Shared KYC/AML + sync |

|

Balance Visibility |

No |

Yes |

|

Top-Up Confirmation |

Manual/Delayed |

Real-time |

|

Scalability |

Moderate |

High |